Analytics Study 2017: Consumer Goods

The Bar Keeps Getting Raised

CG companies are struggling to keep up with the data-driven market leaders

Consumer goods companies as a group have a longer track record than retailers do in using analytics to understand and drive the business. But as digital has gained steam, data availability has mushroomed and analytics capabilities have taken a quantum leap forward, many CG companies have struggled alongside retailers to keep up with the data-driven market leaders.

That’s particularly the case for the CG companies that responded to the survey supporting this report. The majority (65%) of last year’s respondents had annual revenues of $1 billion or more, while just 46% of this year’s respondents were that large, and the percentage of sub-$100 million CG companies doubled. With fewer resources, these SMB respondents face even greater challenges at achieving par with competitors in their ability to wield analytics power to understand, serve and influence customers.

But the good news is that CG companies recognize this deficit, and are focusing their investments moving forward on analytics capabilities that support their customer-centric business goals. They are also continuing to build up their already well-established analytics acumen in supply chain to further their maturity in areas such as planning and demand forecasting.

Analytics Maturity

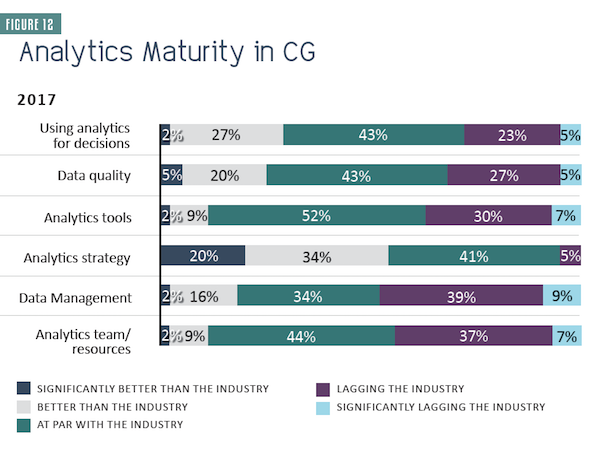

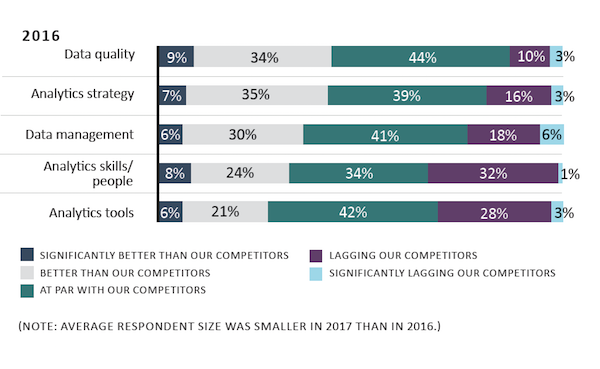

This smaller-skewing group of CG companies see themselves lagging their competitors significantly in analytics data quality, data management and analytics team/resources, which have continued to challenge the industry as a whole (Figure 12). Getting the right analytics tools in place also looms as a huge challenge. These basic building blocks are critical to creating the bedrock on which analytics-driven organizations are built.

“There’s an element of greater pessimism on their performance across everything that we’re seeing,” says Gaurav Pant, chief insights officer at Incisiv (and formerly principal analyst at EKN Research). “They generally feel that they’re not doing as well as they should be.”

When Amazon’s substantial analytics prowess is the yardstick, CG respondents’ self-evaluation is even more dismal. At least 80% of respondents rate themselves as lagging or significantly lagging Amazon in every aspect of their analytics programs. That’s not all that much higher than the scores last year’s respondents gave themselves compared to Amazon. It’s possible that until Amazon began ramping up its private label business in some categories, some CG companies did not see them as head-to-head competitors, and therefore did not aggressively invest in technologies to improve their chances to compete.

Supply Chain Maturity

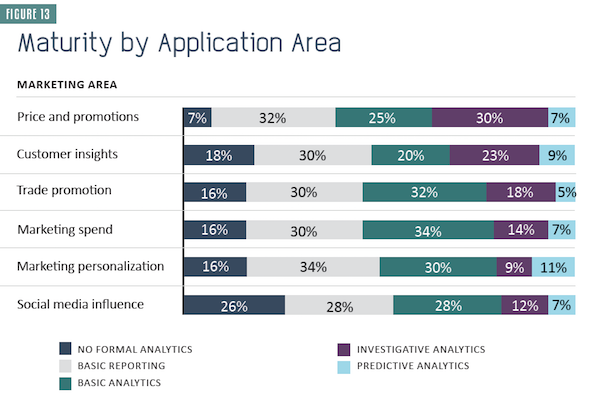

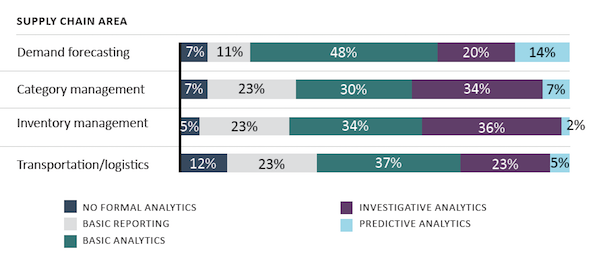

CG companies’ growing efforts to develop direct consumer relationships through digital channels is reflected in the increasing application of advanced analytics capabilities in areas such as price and promotions and customer insights, where greater transparency is yielding rich data (Figure 13). Marketing personalization and social media influence are also seeing the use of advanced analytics.

Trade promotion capabilities are similar to these categories in the application of advanced analytics, but this is a much more mature area, so investment to push to more predictive analytics capabilities may be lagging because CGs have found it challenging to derive value.

CG companies are far more mature in inventory and supply chain analytics, with 41% using investigative or predictive analytics in category management and nearly as many in inventory management. Demand forecasting leads use of predictive analytics at 14%.

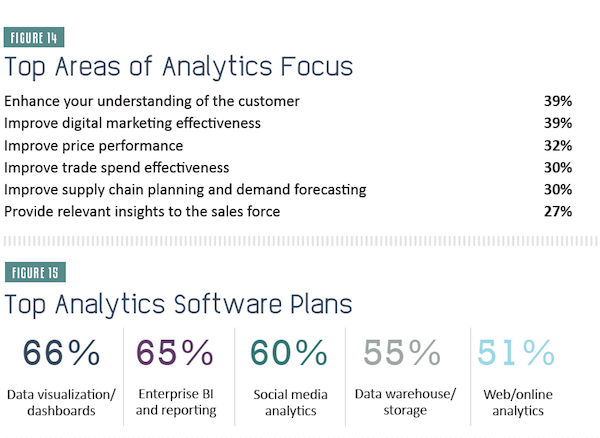

CG companies’ business goals are clear in their analytics priorities (Figure 14). Enhancing understanding of the consumer and improving digital marketing effectiveness lead the list at 39% each, followed by improving price performance and trade spend effectiveness. All are indicative of CG companies shifting from an operations and execution focus to getting to know consumers more directly through digital channels.

According to McKinsey’s 2016 survey of North American companies, CGs that are besting their competitors are twice as likely to view advanced analytics as critical to business strategy and are building “insights factories” — analytical models, tools, and processes ― to do so.

Investment Focus

CG companies struggle to establish a firm foundation for analytics ― especially small and mid-size firms. Top areas for adding new software, upgrading existing systems or changing to a new supplier are data visualization/dashboards, enterprise BI and reporting and social media analytics (Figure 15). These areas all reflect a desire for CG companies to build capabilities that deepen consumer relationships and make effective use of digital marketing.

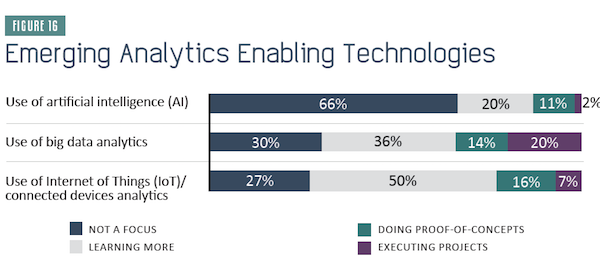

At the same time they’re shoring up core capabilities, CGs must keep up with emerging technologies that will support analytics programs in the future. Big data analytics is furthest along in moving from that watchful state into proof-of-concept and executed projects (Figure 16). Internet of Things applications follow, while artificial intelligence remains the least explored.

AI might be the answer to some of the integration woes CG companies cite as among their top challenges. “Data needs to be harmonized and synchronized, and CGs have a great opportunity to use artificial intelligence to manage the context with master data,” says Lora Cecere, founder and CEO, Supply Chain Insights.

Obstacles to Progress

As seen in Figure 12, CG companies as a group are generally frustrated with their progress in analytics, and they lag in maturity on some fundamental infrastructure needed to build themselves into more sophisticated, insights-driven organizations.

That frustration is clear in their rankings of the top challenges to leveraging analytics more strategically. Limited software toolsets and inability to integrate data from multiple sources tie at 36% each to lead the list (Figure 2 in overview section).

This is no surprise: Small and midsize CG companies in particular have a difficult time funding foundational investments in tools and data management infrastructure when the return on those investments may be far off. Data integration has long been a struggle, but it is particularly vexing as CGs increase their focus on the consumer.

People issues ― both the culture and the need to staff appropriately to derive the most benefit from analytics ― are also top challenges.

“We are limited by talent availability,” says Cecere. “The industries of financial services, insurance and telecom are sucking up the available resources with better salaries. The consumer industry is a laggard. The jobs just are not as interesting, the executive teams not aligned, and the salaries are not as competitive.”

Presumably, the CG industry’s budget plans will address at least some of those gaps. Analytics accounts for an average 11.3% of IT budgets now, but will rise to 18.1% by 2021.

Just under half (45%) are spending a portion of that budget on outsourced resources to provide data analytics; another 14% have plans to do so. For small and mid-size CGs who feel their in-house foundation for building a strong analytics platform is lacking, outsourcing may be the right path to catch up with analytics leaders.

The race to build closer relationships with consumers is on, and CG companies know analytics turbo charges those efforts. Many are working diligently to build their programs, allocating a larger portion of IT budgets, working on data integration, tool and management issues and seeking to attract the right talent. While frustrated at the pace, they are slowly making progress.

________________________________________________________________________

TABLE OF CONTENTS

- Analyst's Note: The Great Analytics Divide

By: Gaurav Pant, Chief Insights Officer, Incisiv

- Overview: Analytic Growing Pains

Retail and CG companies struggle to get the right people, governance and technology.

- Retail Section: Analytics Transformation Mid-Stream

The retail industry is in an analytics arms race. May the best insights win.

- Supplier Section: The Bar Keeps Getting Raised

CG companies are struggling to keep up with the data-driven market leaders.

- Click here to Download a PDF of the FULL STUDY