Analytics Study 2017: Overview

Analytic Growing Pains

Retailers and CG companies struggle to get the right people, governance and technology

Analysts widely agree that the future for both retailers and consumer goods companies relies heavily on digital engagement and their ability to understand the consumer.

The story unfolding in both industries is one of striving to collect more rich and varied data; mastering the complexities of cleaning and managing it; and assembling the right assortment of tools, talents and processes to quickly draw and act on the analytic insight. Organizations must also move analytic capabilities for specific application areas along the maturity ladder according to each one’s ability to deliver dividends through the insights they produce.

Shifting organizational structure and culture so profoundly is a substantial undertaking demanding executive-level commitment, significant resources and strong change management. Retailers and CG companies must accomplish all this in a marketplace that is also rapidly changing. They face constant evolution in omnichannel expectations and digital platforms as well as consumer demand for an ever-widening array of delivery options. Add in the implications of emerging technologies such as artificial intelligence and the Internet of Things and life gets even more complicated.

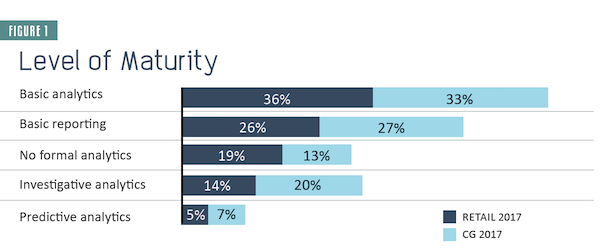

It’s a fast-moving target. That’s one reason both retailers and CG companies report little overall improvement in moving the needle on analytics maturity (Figure 1). For every prescriptive analytics capability they gain, they must start at square one with a new application area that pulls back their overall average.

So while retailers in particular report making real progress against their competitors in analytics, as a group they feel there is still lots more work to be done to get beyond the basics. Small and mid-size CG companies work in an industry that is generally further along in analytics, but they remain bested by deep-pocketed leaders who have rebuilt their businesses to be data-centric.

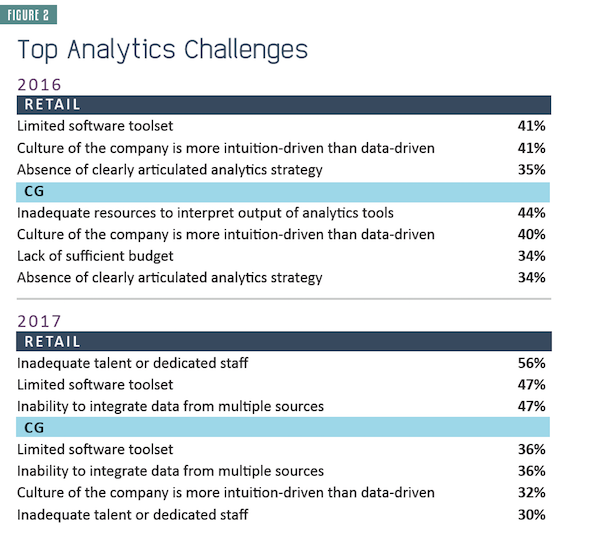

Retailers and consumer goods companies face similar obstacles in pushing their analytics programs along, with technical and organizational challenges dominating the tops of their lists (Figure 2). They share issues with limited tool sets, inadequate staff and data integration woes. But while retailers cite the lack of a centralized analytics process ― a structure issue ― CGs are more concerned about the cultural change: Getting staff to think more analytically across the organization. Shifting a culture can lag technology advancement by years.

It’s easy to get discouraged in the face of so many obstacles, but companies can overcome their data analytics hurdles by readjusting their thinking about how to define success. “Don’t let the perfect be the enemy of the good,” says Robert Hetu, research director, Gartner Retail Industry Services. “Some companies are paralyzed by data and analysis, seeking the perfect answer. A good answer based on relatively accurate data that is arrived at quickly is preferable to a perfect answer — if that were even possible — that takes weeks or months to develop.”

Getting Talent Right

One significant obstacle both CG companies and retailers struggle with in the quest to become more mature analytics organizations is assembling the right talents and skill sets to get a handle on their data and generate actionable insights. Figure 2 highlights the issues both sides face with inadequate talent or dedicated staff.

“There are two problems,” says Gaurav Pant, chief insights officer at Incisiv (and formerly principal analyst of EKN Research. “The first is you don’t have enough of the right people to analyze the data. The second is you’re able to do all the grunt work but you have few people who can make sense of it, to translate it from a business action perspective.” Retailers and CG companies must feel their way to a best-fit strategy for both how the team is put together and the responsibilities of each member.

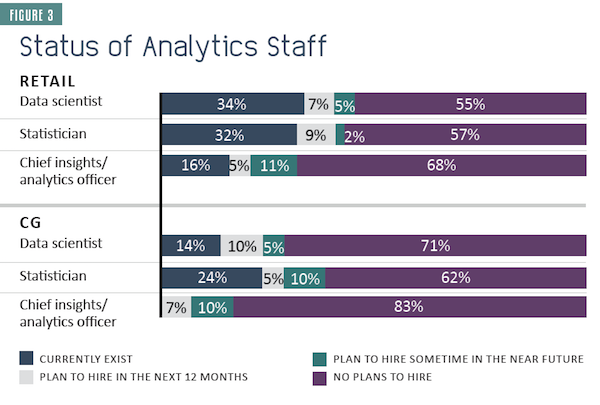

Despite naming the talent gap as a significant pain point, both CG companies and retailers are not planning to do much to change it (Figure 3). While CG companies are starting out better staffed, neither plans to hire aggressively. The handful of CG companies and retailers who rate themselves as beating Amazon in analytics maturity are also likely the ones pushing forward in hiring.

To close the talent gap, Ken Morris, principal at Boston Retail Partners, recommends companies develop solid relationships with local universities to foster strong analytics programs, then tap that talent pool. Already, such programs are increasing the availability of data scientists, he says. “The new and more difficult to address talent shortage is [finding] analytics leaders that have deep business/functional/industry expertise balanced with enough quantitative awareness/understanding to define strategy and execution for analytics opportunities.”

There is a critical need for retailers to hire chief digital officers, which is “an absolute requirement if a retailer plans on being in business in 2025,” says Jeff Roster, VP of retail strategy for IHL Group. “The stakes have never been higher. The margins for error have never been smaller. Amazon has redefined customer expectations of inventory visibility, two-day delivery and endless aisle. Every retailer must respond or risk being an afterthought in the customer’s mind.”

Who Runs Things?

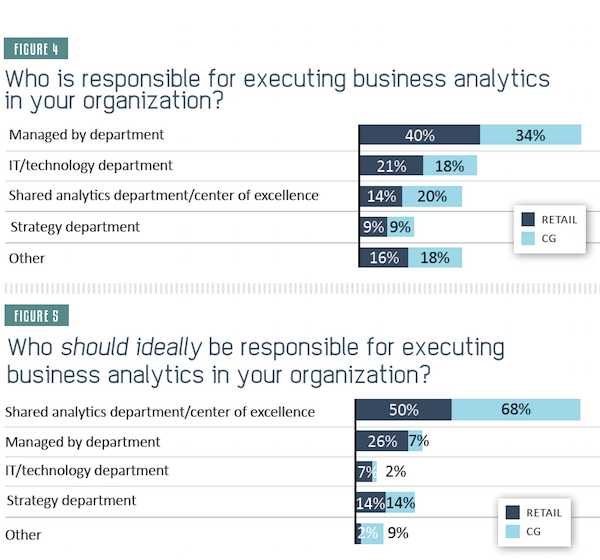

Closely related to the proper staffing of analytics functions are their governance. Currently, both CG companies and retailers tend to place responsibility for managing analytics resources within the departments that use them (Figure 4). CG companies are slightly more likely than retailers to embrace a centralized approach through an analytics department or center of excellence, treating analytics as a shared service.

The current dominance of decentralized analytics is also seen in levels of shadow spending. Nearly half (48%) of consumer goods companies and at least a quarter (26%) of retailers report purchasing BI/analytics software outside the IT budget last year, with many others unsure of just who is funding these efforts. Unifying analytics spend is one potential outcome of moving to a centralized analytics department or center of excellence ― considered widely by both sides as the ideal approach (Figure 5).

EKN Research’s Pant expects companies to use a center of excellence approach as a means of structuring their operations and gaining competence in analytics, then moving the expertise out into individual departments in five years or so. A category manager, for example, would simply need analytics competency as part of the skill set.

Data Sharing Slogs Along

Analytics is all about putting data in context to gain insights that drive business decisions. Drawing data from a wider pool often enriches owned data with new perspectives and data points that enhance the understanding of every aspect of the business, including the all-important consumer.

But CG companies and retailers have a long, fraught history with data sharing. Despite analyst views that both to better on-shelf availability, some retailers remain skeptical about sharing the needed data, preferring to keep some data close to the vest ― or charge their partners a fee.

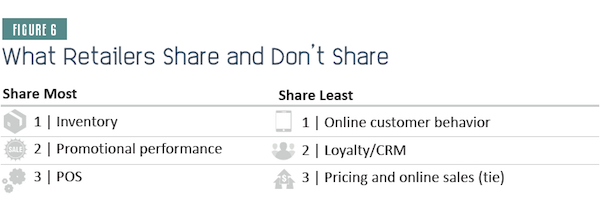

For that reason, data sharing is still limited. CG companies and retailers agree that inventory, promotion performance and POS data are the most shared. Weekly or daily sharing is most common, although a surprising percentage is still ad hoc. The numbers haven’t shifted much in recent years, but since this year’s average CG company respondent is smaller, survey results could indicate that data sharing for these well-established data types is becoming standard across the industry. That’s good news for analytics programs across the board.

But the big focus now is on using data to better understand customers, and that’s where old habits kick in. Many retailers are highly reluctant to let consumer goods companies gain access to their valued customer data. Fully 70% do not share online customer behavior data, and just over half do not part with loyalty/CRM, pricing and online sales data. There is some good news, however. There is upward movement in data sharing of all three “share least” data types compared to 2016. Pricing data saw the biggest rise.

CG companies must hope this trend continues. According to McKinsey, CG leaders in their categories are much more likely to be closely partnering with online retailers to obtain more customer data and use their own sites to increase understanding of consumers.

“Our survey revealed that all winners receive full-basket and shopper-panel data from retailers; most winners also receive loyalty-card and coupon-redemption data,” according to McKinsey’s “Winning in Consumer Packaged Goods through Data and Analytics” report. That puts CGs at a distinct advantage in achieving customer insights over companies who are still battling to obtain this retail data.

The digitally empowered consumer is disrupting traditional approaches to managing every step of the consumer goods/retailer value chain. As Amazon has demonstrated, the more you can understand consumer expectations, the better you can anticipate, respond to and even shape them. All that takes a substantial investment in people, resources and culture change. Both retailers and consumer goods are working hard to keep up with a moving target. They are making progress but are also continually challenged to adapt to new demands.

____________________________________________________________________________

TABLE OF CONTENTS

- Analyst's Note: The Great Analytics Divide

By: Gaurav Pant, Chief Insights Officer, Incisiv

- Overview: Analytic Growing Pains

Retail and CG companies struggle to get the right people, governance and technology.

- Retail Section: Analytics Transformation Mid-Stream

The retail industry is in an analytics arms race. May the best insights win.

- Supplier Section: The Bar Keeps Getting Raised

CG companies are struggling to keep up with the data-driven market leaders.

- Click here to Download a PDF of the FULL STUDY