Sales & Marketing Study 2018: Trade Promotion Management

Working Off the Same Page

Running a concurrent shopper marketing campaign can improve support for a trade promotion program by 22%; adding a trade promotion component can improve the ROI of shopper marketing eff ort by 29% (see chart 2). The higher the level of integration between the two, the better the incremental results can be, according to extensive data analysis from Foresight ROI.

With data like that readily available, it would seem logical that shopper and trade programs would be planned, sold in and executed in lockstep by this point in time. After all, they’re typically conducted in the same venues and targeted at the same shoppers (or at least similar pools). Heck, they even often employ the same marketing tactics.

Then again, the CG industry hasn’t always operated logically. These are, after all, the people who used to sell hot dogs in packs of 10 and buns in packs of eight.

And so, in many organizations, shopper and trade aren’t in lockstep — they’re simply trying to avoid stepping on each other’s toes. Case in point: While walking attendees through a “best practice” example of the annual trade planning process at a recent industry event, the presenter identified the most likely stage at which the shopper plan might be considered.

“Wouldn’t it make sense to have someone looking across all of these things?” asks Craig DeSimone, director of global revenue management at Kellogg Co. “Companies need to understand better that this is all a commercial investment,” said DeSimone, adding that he believes Kellogg is farther ahead than most CGs in this regard.

This understanding is becoming even more critical. In fact, there has been recent discussion across the industry not only about aligning shopper and trade activity, but about building systems and processes that will let companies integrate planning and analysis across trade, shopper, national consumer promotion, digital marketing, e-commerce and even packaging to provide a holistic view of all commercial spending. The spider web-style path to purchase caused by the move to omnichannel shopping has made doing so far more of a business imperative than it ever was before.

Moving toward such a broad commercial view requires companies to take a fresh look at the key building blocks they use for planning, execution and performance management to develop better methods of upstream strategic collaboration.

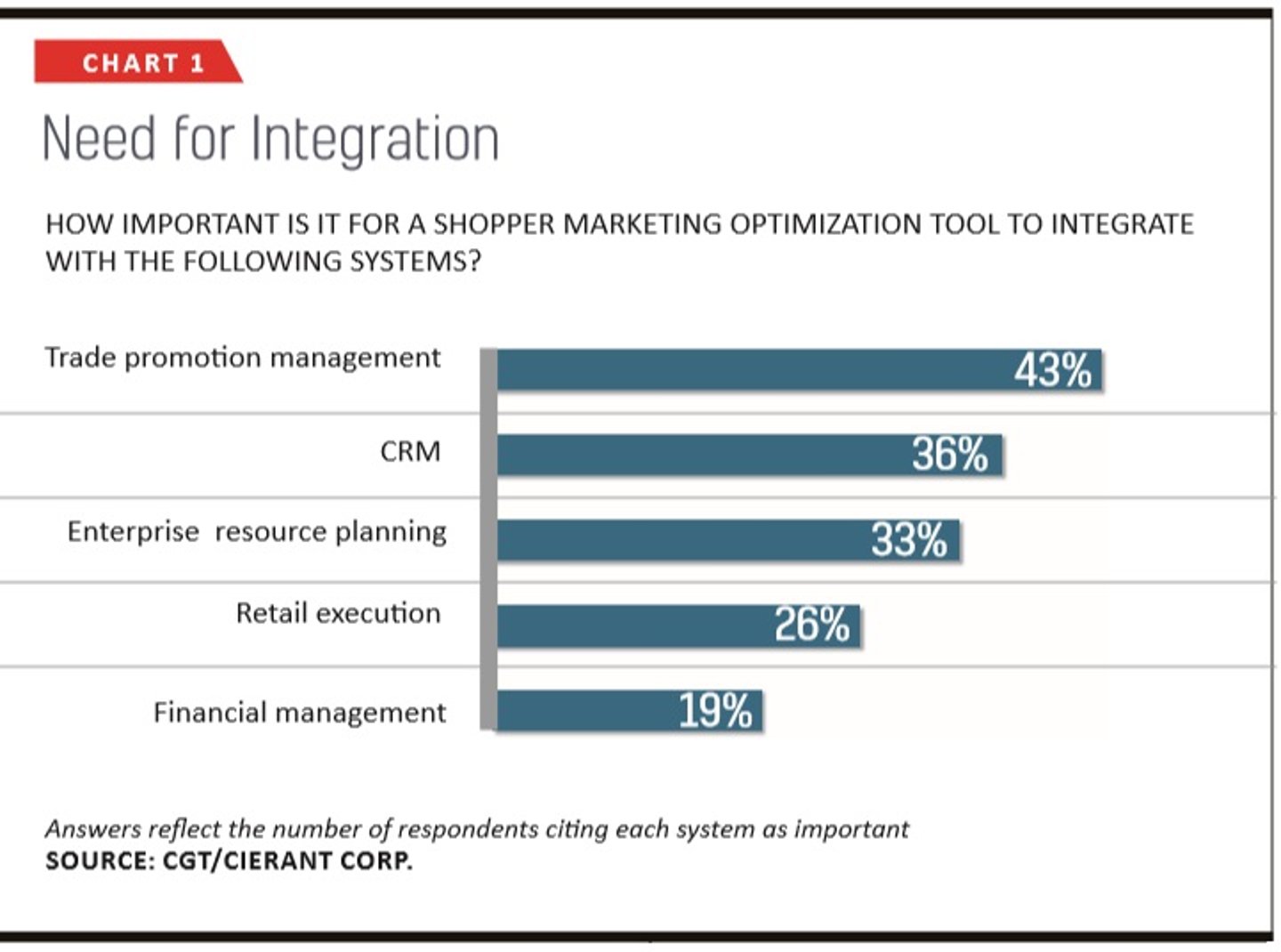

It also might require them to use a “blank sheet” approach for budgeting that could be facilitated by another recent industry trend: zero-based budgeting. Roughly one-fifth of CGs have already forsaken the traditional year-over-year approach to budgeting and are starting from scratch, according to recent research from CGT and Cierant Corp.

While some ERP platforms are working on this growing need for alignment, there currently is no single tech stack that will let companies easily analyze all investments together, analysts say. If and when there are, revamping or even replacing existing systems to accommodate the big-picture view will require significant time and resources.

That’s why PwC Strategy& suggests initiating the change when the organization is already planning a major technology implementation (like the migration to S/4HANA being undertaken by many of SAP’s clients). Such upgrades are an ideal time for companies to determine what business process improvements can be undertaken to make the implementation even more effective.

Taking the First Step

It’s hard to imagine full commercial alignment anytime soon, however, when most companies still aren’t even doing a good job uniting shopper and trade.

Despite widespread acknowledgment of the need, some standard industry issues have kept this from happening. The first is the aforementioned siloed nature of business functions at most CGs. Trade is a sales activity, and shopper does have “marketing” in its name. Different departments and separate budgets don’t lend themselves to easy alignment. Another issue is the fact, despite the many similarities, the shopper and trade practices aren’t quite apples to apples — maybe more like oranges to tangerines, with somewhat different objectives and KPIs.

For one, the short-term analysis typically used to measure trade programs “isn’t going to be effective for shopper marketing,” DeSimone says. And the longer-term measurement needed to prove out shopper is often more difficult and, therefore, more expensive, to obtain. Marketing mix analysis tools, meanwhile, “only get at shopper a little bit” because of the narrow scope of most programs, he says.

At an even more basic level, many organizations haven’t even adopted good processes for managing shopper marketing itself, let alone take steps to align it. As a discipline, shopper hasn’t quite refined itself to the level of trade, partly because it’s a newer but also because it is nowhere near as big a cost center for CGs.

Trade promotion spending, the second largest line item at most consumer goods companies (after cost of goods sold), represents somewhere between 16% to 25% of gross sales. It’s been a necessary evil of the CG industry since the early 1970s.

With that much money at stake (about $500 billion worldwide, according to some estimates), it’s become imperative for CGs to track their spending as efficiently as possible. Not that the eff ort always works: For all the sophisticated management and optimization tools now available, a fair number of companies are still emailing spreadsheets from one department to another.

Shopper marketing as a distinct discipline of the CG organization isn’t as old (roughly 12 years, give or take), or as costly (about 2% of sales, according to Path to Purchase Institute). So the impetus to build systems and processes to manage shopper activity hasn’t been as strong.

But this obstacle, at least, is being addressed, thanks to the arrival of solutions that can help manage shopper. In addition to the aforementioned Foresight ROI, companies like Cierant and Shopperations are providing tools to help CGs gain greater transparency into their activity.

“There is room for us to be more like scientists and not just artists,” says Olga Yurovski, who left her job as a shopper marketing director at what was then ConAgra Foods several years ago to launch Shopperations. “I always felt jealous about not having a system like the salespeople had. They were always so buttoned up with their financial reporting.”

The need is understood: According to the aforementioned CGT/Cierant study, 84% of companies believe that improving shopper marketing agility and cost-effectiveness has become more critical in the last two years.

Finding Common Ground

Aligning shopper and trade activity “is absolutely our goal” at Conagra Brands, according to Bob Waibel, the company’s senior director of shopper marketing. “We work very hard to make sure that we’re aligned with a holistic plan.”

The CG operates primarily as a field-based organization, with shopper marketers embedded within the customer sales teams at key accounts like Walmart and Kroger. So shopper isn’t so much a separate discipline as the bridge between brand and sales, a mechanism for “bringing the brand plan into the retail environment,” he explains.

Conagra currently uses separate tools to manage trade (Blacksmith Applications) and shopper (Shopperations) activity. So the next step will be to gain more detailed clarity by aligning the solutions “sooner, rather than later,” Waibel says.

“We are reasonably well aligned with our funding,” with trade and shopper activity managed largely from the same budget, says John Clement, director of sales planning & innovation at Welch Foods. The two activities also are considered together during the annual planning process for retail accounts, he says.

“Some of it is just a function of our size and the way we’re set up. We don’t have a 10-person shopper marketing department that’s located somewhere else,” because shopper sits within the sales department, Clement notes. “We’re a team that’s working together consistently throughout the week” and in constant contact with field teams. “So we’re not disconnected.”

The company uses TPO software from T-Pro Solutions (and other tools) to keep the activity adequately aligned. “We’re getting better at it,” Clement says.

In general, then, the industry does seem to be heading in the right direction. Wayne Spencer, president of T-Pro Solutions, thinks shopper marketing management/ optimization tools will be adopted faster than their trade promotion counterparts were. “You need to merge the two silos to optimize the two investments,” he says. “It’s a natural progression.”

The first thing companies must do is “realize what the opportunity is,” says Rick Abens, chief executive officer and founder of Foresight ROI (and another ConAgra veteran). Abens believes that most CGs are working to align the two functions. “It’s just a matter of degree and the level of success.”

Increasingly, the level of overall success for CGs will depend on how well they do in aligning their commercial spend.

To read the rest of the 2018 Consumer Goods Sales & Marketing Study, click on the links below:

- Editor's Note: Confronting the Consumer-Driven World

- The Progress Report: 'Improvement' Is for Losers

- Organization: Taking the '&' Out of Sales & Marketing

- New Product Development: A Made to Order Marketplace

- Data & Analytics: Going Deeper with the Data

- Trade Promotion Management: Working Off the Same Page

- Consumer Engagement: Something to Talk About

To download a PDF of the full report, click on the attachment below.