Overcoming The Margin Squeeze

The global consumer packaged goods industry is facing an accelerated margin squeeze, which threatens its ability to attract investors seeking longterm growth and profitability. This margin squeeze is the result of numerous well-known factors, including rising commodity costs, product substitution such as private label, and migration of consumers away from traditional channels. Through the strategies pursued in the last decade of reengineering, portfolio rationalization and strategic sourcing, many consumer packaged goods (CPG) companies have wrung most of the cost efficiencies out of their operations. This article will explore forward-looking growth strategies to escape the margin squeeze.

ORGANIZE FOR INNOVATION

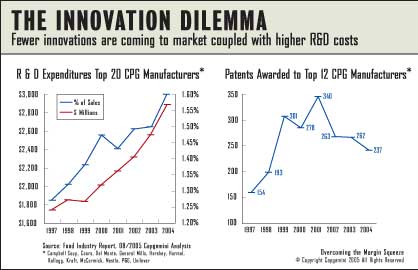

New approaches are required to better tap external sources for new products and incorporate them into internal product development. Relying primarily on internal R&D staff to develop new products is increasingly ineffective and expensive. New product development investment for the top 12 CPG manufacturers climbed to 1.6 percent of sales in 2005, increasing more than $1 billion over the last six years. Yet more than 85 percent of new products were discontinued within a year of launch. New approaches include:

New approaches are required to better tap external sources for new products and incorporate them into internal product development. Relying primarily on internal R&D staff to develop new products is increasingly ineffective and expensive. New product development investment for the top 12 CPG manufacturers climbed to 1.6 percent of sales in 2005, increasing more than $1 billion over the last six years. Yet more than 85 percent of new products were discontinued within a year of launch. New approaches include:

- "Connect and develop" model: A company dedicates a business development team to connect external innovators with cross-functional company teams. This way, company employees become stakeholders in sourcing and evaluating external ideas and channeling them through the company.

- Venture capital model: By creating a corporate venture fund that invests in promising third-party innovations, companies cut risks by commercializing new ideas when they are likely to succeed.

- Supplier collaboration for innovation: Reward suppliers for cost savings, new product development advice and bringing innovations to the table.

- Leveraged shared service center model: Companies can spur innovation by separating the creative side of innovation from the science side of innovation. Specifically, this means increasing the focus of brand groups on new products and designs, while other parts of the organization provide the capabilities to bring new products to market.

Historically, the focus on improving innovation has been on process. Today, strategy and organization are the new levers to spur innovation.

THINK AND ACT LIKE RETAILERS

As retailers continue to exert pressure, the industry will reach a new inflection point within the next two to three years. CPG companies will increasingly take responsibility for stocking, promoting, pricing, allocating and planogramming product at the shelf on behalf of their retail customers. CPG companies will "own the shelf." There are three capabilities CPG firms need to acquire in this area:

As retailers continue to exert pressure, the industry will reach a new inflection point within the next two to three years. CPG companies will increasingly take responsibility for stocking, promoting, pricing, allocating and planogramming product at the shelf on behalf of their retail customers. CPG companies will "own the shelf." There are three capabilities CPG firms need to acquire in this area:

- Consumer-driven replenishment: Successful CPG firms will use point-of-sale (POS) data to generate sales forecasts based on real market intelligence, such as the effect of promotions, price changes, competitive pressures, store resets and remodels, weather changes and competitive actions.

- Store based micro marketing: One-size-fits-all mass marketing approaches simply don't work as well as they once did. CPG manufacturers must demonstrate to retailers that they are valuable, collaborative partners by bringing merchandise, assortment planning and space management capabilities.

- Trade promotion management: Most manufacturers view trade promotions as an unprofitable, but necessary part of doing business. Yet when executed well, promotions drive long-term value with the retailer, improving the brand image.

The traditional CPG go-to-market is giving way to companies that "think and act like a retailer."

| DEVELOP MEAL SOLUTIONS The consumer "meal solutions" market has emerged as the most significant new revenue stream in the industry. In 1950, just one of every four consumer food dollars was used to buy prepared meals. Today, time-starved consumers buy almost half of their meals from restaurants, grocery deli counters and other retailers. To address this new market, food manufacturers will need to make significant adjustments to their operations. |

First, manufacturers need to move from a productmanufacturing and marketing-sales mentality to an aggressive consumer service and solutions based goto- market approach. Second, manufacturers need to reconfigure inventory management and logistics systems. This is a critical steps to incorporate new demands of obsolescence and quality. Capturing this emerging revenue stream is the most significant growth platform available in the mature markets of North American, Europe and Japan.

SUCCESS IN EMERGING MARKETS

With growth slowing in mature markets, the best opportunities for growth are found elsewhere in developing economies. By 2020, the top food markets in the world will include China, India, Japan and Russia. To succeed, CPG manufacturers will need to:

With growth slowing in mature markets, the best opportunities for growth are found elsewhere in developing economies. By 2020, the top food markets in the world will include China, India, Japan and Russia. To succeed, CPG manufacturers will need to:

- Act on unique consumer requirements: To drive sales, companies may need to change their brand positioning, develop new products, customize product packaging and adjust advertising strategies for each market.

- Tap the value market: The vast majority of consumers (80 percent in China and 90 percent in India) are lower- to middle-income wage earners. CPG manufacturers must focus on the value market segment by lowering product costs and adjusting quality without compromising brand image.

- Overcome fragmented distribution networks: To overcome emerging market challenges, CPG companies must partner with third-party distributors in each market.

THE PATH TO SUCCESS

The relentless margin squeeze that CPG manufacturers are under will only continue. These four strategies call for a dramatic shift in how companies innovate, go-to-market, collaborate and enter new markets. Adopting these strategies will allow companies to once again prove themselves attractive to investors seeking long term growth and profitability. CG

The relentless margin squeeze that CPG manufacturers are under will only continue. These four strategies call for a dramatic shift in how companies innovate, go-to-market, collaborate and enter new markets. Adopting these strategies will allow companies to once again prove themselves attractive to investors seeking long term growth and profitability. CG