Studying Innovation

By now you are familiar with IBM's Global CEO Study conducted in 2006: "Expanding the Innovation Horizon." Section four opens with the following statement: "In case there was any doubt about whose responsibility it is to foster innovation, CEOs cleared that up quickly. Their most frequent response was, 'I am.'" From the mouths of CEOs to the mouths of consumers, the other most frequently cited factor that is critical to successful innovation is consumer insights.

Sounds simple enough, right? An innovative aligned culture along with a consumer focus equals repeated wins for all. Yet, this formula requires massive shifts in traditional leadership thinking, staid business processes and established practices. Study after study indicates gaps in the theory of what it takes to be a master innovator and the reality of how it's truly done. What follows are highlights from recent research reports, and though from different, and often competitive companies, many of the results and conclusions are the same.

HIGH PERFORMERS

"A focus on innovation does pay dividends for a company," says Renee Sang, partner, Accenture Customer Innovation Network. Accenture research has identified a select group of companies in each industry, called "high performers," that have been able to repeatedly outperform their peers over a sustained period.

"A focus on innovation does pay dividends for a company," says Renee Sang, partner, Accenture Customer Innovation Network. Accenture research has identified a select group of companies in each industry, called "high performers," that have been able to repeatedly outperform their peers over a sustained period.

"These high performance businesses not only have a consistent agenda of growth, but continuously innovate within their core offering and explore new offerings to enhance their portfolio," she points out. "They don't necessarily spend more on R&D - in fact, in some segments, there is no correlation between R&D spend and high performance. However, there is a correlation between high performance and continuous innovation."

Yet, according to Sang, most consumers aren't seeing the innovation either in the product or in the experience. In a recent Accenture survey, consumers conveyed a message; they have difficulty finding truly "hot" gift items - only 38 percent of the time do they get what they want. Respondents also said that the shopping experience is much more complex - only 14 percent of shoppers reported an improved experience from two years ago.

"Internally the story isn't much different," notes Sang. "Through AMR's research, 'Innovation and PLM in Consumer Products,' which is just being released, we've learned that companies aren't satisfied with the profit contribution of their new products and services. In 2007, less than two-thirds of the products brought to market met internal goals."

| Thus, in the quest for leveraging product innovation to "win the hearts" of consumers, Sang mentions several critical actions: gauge, anticipate and predict the consumer's needs; move from concept to customer experience - fast; |

and innovate through a network (internal and external) - there are no silos of innovation. Other AMR findings include:

- Forty-four percent cite "demand insight" is the primary driver of product innovation; ahead of technology (35 percent) and design (21 percent). However, the same respondents admitted that the primary reason new products fail is because "the product did not meet customer needs."

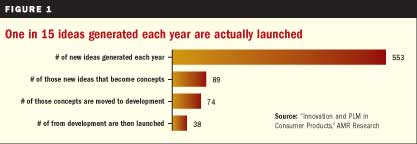

- One in 15 ideas generated each year are actually launched (see Figure 1).

Companies revealed what they consider to be "breakthrough" innovations take up to three years from idea to market.

- Seventy-three percent say that "on-time to market" was of great importance in determining new product commercialization success, yet only 45 percent viewed themselves as successful on this metric

CHANGING WANT INTO NEED

Sid Abrams, principal and U.S. CPG Sector leader, consumer business industries, Deloitte Consulting LLP, also discusses product misses and opportunities in his report: "The Future of Consumer Product Companies: Products, Staying a Step Ahead." He talks about a "saturated" product market in which consumer goods companies repeatedly introduce "cliche" new products and/or line extensions, which produce diminishing returns. What's the answer? He says, "A need is non-negotiable; a want is 'take it or leave it.' For this reason, we believe that the desired goal of new product development should be to satisfy a customer need - not want - more effectively than the competition."

Sid Abrams, principal and U.S. CPG Sector leader, consumer business industries, Deloitte Consulting LLP, also discusses product misses and opportunities in his report: "The Future of Consumer Product Companies: Products, Staying a Step Ahead." He talks about a "saturated" product market in which consumer goods companies repeatedly introduce "cliche" new products and/or line extensions, which produce diminishing returns. What's the answer? He says, "A need is non-negotiable; a want is 'take it or leave it.' For this reason, we believe that the desired goal of new product development should be to satisfy a customer need - not want - more effectively than the competition."

To accomplish this objective, Abrams suggests that customers be segmented "in such a way that exposes an unfilled need." This, he says, transforms a want into a need. He cites toothpaste as an example. The "transformative approach" looks at toothpaste as only one component of a bigger need: oral hygiene. This "leap" in thinking enables a company to expand its thinking to include "adjacencies."

"Such was the case when Procter & Gamble (P&G) developed Crest Whitestrips, a product that transcends a customer's need [for clean teeth] to satisfy a related, but slightly different, want [for white teeth]. At what point does a want become a need? When a viable solution becomes available and affordable. Before Whitestrips, teeth whitening was an expensive dental procedure. Now, it's as simple as a trip to the corner drug store. By making 'white teeth' relatively easy to attain, P&G made 'white teeth a new consumer need," he writes.

So, Abrams then asks, how does a consumer goods company become consistently innovative? "Perhaps not surprising, in companies that innovate well, innovation is a corporate objective just like any other - revenue, profit, return on investment, return on assets, productivity or growth."

Abrams says Deloitte has identified three business practices that "effective innovators" share: "disciplined risk taking, customer-driven experimentation and collaboration - inside the enterprise and beyond."

The bottom line is sustainable growth. Abrams concludes, "Our research shows that innovation can be an engine for sustainable growth, but only when it's actualized through disciplined, repeatable processes and enabled by a robust infrastructure."

LEADING INNOVATION

The McKinsey Quarterly 2008 Number 1, "Leadership and Innovation," by Joanna Barsh, Marla M. Capozzi and Jonathan Davidson, reveals that more than 70 percent of the senior executives who responded to a September 2007 McKinsey survey say innovation will be at least one of the top three drivers of growth for their companies in the next three to five years. However, 65 percent also answered that they were only "somewhat," "a little" or "not at all" confident about the decision they make in this area.

The McKinsey Quarterly 2008 Number 1, "Leadership and Innovation," by Joanna Barsh, Marla M. Capozzi and Jonathan Davidson, reveals that more than 70 percent of the senior executives who responded to a September 2007 McKinsey survey say innovation will be at least one of the top three drivers of growth for their companies in the next three to five years. However, 65 percent also answered that they were only "somewhat," "a little" or "not at all" confident about the decision they make in this area.

Naturally, the authors ask: "What explains the gap between the leaders' aspirations and execution?" They believe that even just starting to build an innovative organization is more frustrating than those charged with the task realize. And while they deem innovation an important growth driver, one-third say they manage innovation on an "ad-hoc" basis. "Our experience convinces us that a disciplined focus on three people-management fundamentals may produce the building block of an innovative organization," the authors explain.

They suggest that the first step is to "formally integrate innovation into the strategic-management agenda of senior leaders." Executives should make better use of existing (and often untapped) talent by creating the right environment in which innovation can "flourish." A separate McKinsey survey of global executives discovered that leadership was cited as the "best predictor of innovation performance."

In an innovative culture, people feel that their ideas are valued and feel comfortable expressing and acting on them. "Leaders reinforce this state of mind by involving employees in decisions that matter to them," the authors write.

There is agreement about the cultural attributes that "inhibit" innovation: "bureaucratic, hierarchical and fearful environment." To avoid such feelings, leaders must cultivate a more positive perception. And to assist in building the desired culture, the report proposes embracing innovation as "a top team, turning selected managers into innovation leaders and creating opportunities for managed experimentation and quick success." Holding leaders "accountable" for encouraging innovation also makes a difference, according to the authors.

HIGH-LEVERAGE INNOVATION

According to "The Customer Connection: The Global Innovation 1000" from Booz Allen Hamilton, written by Barry Jaruzelski, vice president and lead marketing officer, and Kevin Dehoff, vice president and global leader of innovation business, "innovation" spending was $15.9 billon for consumer goods companies, compared to top spender $127.4 billion for computing and electronics companies. This study too posed the question: "How do companies innovate successfully?"

According to "The Customer Connection: The Global Innovation 1000" from Booz Allen Hamilton, written by Barry Jaruzelski, vice president and lead marketing officer, and Kevin Dehoff, vice president and global leader of innovation business, "innovation" spending was $15.9 billon for consumer goods companies, compared to top spender $127.4 billion for computing and electronics companies. This study too posed the question: "How do companies innovate successfully?"

"They can spend the most money, hire the best engineers, develop the best technology and conduct the best market research. But, unless their research and development (R&D) efforts are driven by a thorough understanding of what their customers want, their performance may well fall short - at least compared to that of their more customer- driven competitors," the report states.

As part of the study, Booz Allen Hamilton compiled a list of 118 "high-leverage innovators," deemed companies that "got a significantly bigger performance bang for their R&D buck." On the consumer goods side, adidas, Black & Decker, Christian Dior, Energizer, Kellogg, McCormick, Reckitt Benckiser and Reynolds American make the list. "The high-leverage innovators consistently achieve better sustained financial performance than their industry peers while spending less on R&D," the report notes.

Two key factors were common among these companies: "The first is strategic alignment: They work hard to align their innovation strategies closely to overall corporate strategy. The second is customer focus: They all have processes in place to pay close attention to their customers in every phase of the innovation value chain, from idea generation to product development to marketing."

Furthermore, three innovation strategies became apparent after analysis. The authors categorize companies as follows:

- "Need Seekers:" Companies that "actively engage current and potential customers to shape new products, services and processes; they strive to be first to market."

- "Market Readers:" Companies that "watch their markets carefully, but maintain a more cautious approach, focusing largely on creating value through incremental change."

- "Technology Drivers:" Companies that "follow the direction suggested by their technological capabilities leveraging their investment in R&D development to drive breakthrough innovation and incremental change; often try to solve the unarticulated consumer/customer needs."

Interestingly, the "most important finding" was that "no one of these strategies performed consistently better than any other - indeed, high-leverage innovators can be found in each of the strategy categories. The most significant performance differences correlated not with their innovation strategies but with those critical factors mentioned above: strategic alignment and customer focus."

Over the past three years, respondents who say their innovation strategies are tightly aligned with overall corporate objectives "boasted a 40 percent higher growth in operating income and 100 percent higher total shareholder returns than those whose innovation strategies are less aligned." Companies that are more focused on customer insight or market needs are also more successful. "In particular, companies that directly engaged their customer base had twice the return on assets and triple the growth in operating income of the other survey respondents," the study found.

Is there a best innovation strategy for any given company? The authors think so. "It is the approach that best suits - and is most closely aligned with - the company's overall corporate strategy and the competitive environment in which the company operates," claim Jaruzelski and Dehoff.

One "R&D tactic" was used by every company that the authors spoke to: a commitment to tightly managing the innovation process from start to finish. This involved "a disciplined stage-by-stage approval process combined with regular measurement of every critical factor, from time and money spent in product development to the success of new products in the market. This, combined with a strong portfolio management program, has allowed these companies to better understand how their innovation engines promote long-term growth."

Their conclusion: "In the end, the key to innovation success has nothing to do with how much money you spend. It is directly related to the effort expended to align innovation with strategy and your customers, and to manage the entire process with discipline and transparency." CG

Be a Transformer

"The ultimate objective of any innovation is to transform business and transform lives. How do you know if your innovation is of that transformational kind? Here are my definitions that I use for the different stages/types of business:

"The ultimate objective of any innovation is to transform business and transform lives. How do you know if your innovation is of that transformational kind? Here are my definitions that I use for the different stages/types of business:

- If you charge for undifferentiated stuff, then you are in the commodity business.

- If you charge for distinctive/differentiated tangible things, then you are in the goods business.

- If you charge for the activities you perform, then you are in the service business.

- If you charge for the time customers spend with you, then and only then are you in the experience business.

- If you charge for the benefit customers (or "guests") receive as a result of spending that time, you are in the transformation business.

I would argue that to win in the market, you need to aim your innovation efforts towards creating a transformational business."

- From Phil Mckinney's (CTO, Personal Systems Group, HP), Nov. 29, 2007 Blog, www.killerinnovations.com