Readers' Choice Survey 2008

There is no better time for reflection than the New Year; that's why CGT asked its subscriber base to identify their most valued and used solutions and services providers across 11 categories. We hope that the results of our eighth annual Readers' Choice Survey, as well as accompanying commentary from CGT, industry analysts and users in the field, help as you ponder your business and technology choices past, present and future.

TOP 10 LISTS

The results on the pages that follow are derived from the feedback of approximately 150 consumer goods business and IT executives. The ballot spanned a various technology and services categories, including Supply Chain Planning, Customer Relationship Management, Trade Promotion Management, Demand Data Analytics, Business Intelligence, New Product Development and Introduction, Outsourcing and more.

The results on the pages that follow are derived from the feedback of approximately 150 consumer goods business and IT executives. The ballot spanned a various technology and services categories, including Supply Chain Planning, Customer Relationship Management, Trade Promotion Management, Demand Data Analytics, Business Intelligence, New Product Development and Introduction, Outsourcing and more.

Survey respondents were asked to identify the solutions and services vendors they currently use across the aforementioned categories, and rank the customer experience they have had using a scale of one to five

(1 being extremely dissatisfied, 5 being extremely satisfied). Subsequently, the Top 10 list (or Top 5 list, in some cases) for each category was determined by assigning each company a combined score of the sheer number of votes (indicative of their reach in the consumer goods industry) weighed against their average customer experience ratings. The 10 companies (or five) that received the highest combined scores in each category were then ranked accordingly.

To ensure the integrity of the survey process, we asked respondents to only vote in the categories in which they are intimately involved. Thus, supply chain executives voted in categories that touch the supply chain; sales and marketing executives voted in customer-facing categories; innovation-minded executives voted in the new product development and introduction category; and general business and IT executives, because they touch all areas of the business, voted in every category (see Figure 2).

CUSTOMER EXPERIENCE AND SMB MARKET

In addition to our Top 10 and Top 5 lists, CGT recognizes companies in each category that received special accolades from readers for excellence in customer satisfaction and performance in the small to midsize business market. Here is an explanation of each:

In addition to our Top 10 and Top 5 lists, CGT recognizes companies in each category that received special accolades from readers for excellence in customer satisfaction and performance in the small to midsize business market. Here is an explanation of each:

Customer Experience: This list identifies the three companies that received the highest average customer satisfaction rating from users in their respective categories. In addition, we've added a measure, titled "Category Customer Experience," that averages customer experience ratings from all responses in a category.We hope that this measure is indicative of how much value a particular category of solutions or services is providing the consumer goods industry.

SMB Market: This list determines the most widely used services and solutions providers among consumer goods firms with $1 billion or less in revenue. The methodology for this list follows the same rules as that for the larger Top 10 and Top 5 lists -- but the demographic consists only of those executives who identified themselves as working for a small to midsize firm, 44 percent of our respondent base (see Figure 1 and Figure 3).

EDITORS' PICK

Even though this year's Readers' Choice survey contains 11 different solutions and services categories, some companies did not find an appropriate home within its parameters. In response, an "Editors' Pick" page was created to assign recognition for those companies with offerings that support your supply chain, sales and marketing and innovation strategies. While these companies may not have a high volume of customer engagements, may be new to the industry or perhaps they simply don't fit exactly into one specific category, they are making an impact on the industry and are worthy of attention.

Supply Chain Planning

Even though this year's Readers' Choice survey contains 11 different solutions and services categories, some companies did not find an appropriate home within its parameters. In response, an "Editors' Pick" page was created to assign recognition for those companies with offerings that support your supply chain, sales and marketing and innovation strategies. While these companies may not have a high volume of customer engagements, may be new to the industry or perhaps they simply don't fit exactly into one specific category, they are making an impact on the industry and are worthy of attention.

Supply Chain Planning

Consumer goods manufacturers are facing macro-level changes that are strongly influencing their investment in supply chain planning solutions. Globalization and low cost country sourcing are dramatically affecting the logistics and economics of moving raw materials and finished product, steering consumer goods companies toward technologies that will help them understand and optimize these opportunities.

Consumer goods companies are tackling persistent out of stocks with demand signal repositories -- specialized databases for demand data often working in concert with inventory fingerprinting via RFID. While RFID investments have become more pragmatic, "it has raised awareness of other data sources such as point of sale that companies are not doing much with," says Simon Ellis, supply chain strategies practice director for Manufacturing Insights, an IDC company.

Becoming demand-driven has been a common goal, but many consumer goods companies are finding the reality tough. The new approach is "demand aware but fulfillment driven," says Ellis. Attitudes toward planning and forecasting have also changed. Near-term planning is still important, of course: Mother Parkers, a large coffee and tea manufacturer in North America, recently deployed Logility Voyager Solutions to improve demand and inventory planning, gain visibility into market demand and seasonal patterns, and aggregate data quickly for capacity planning, saving $800,000 on safety stock in the first two months; New Era Cap selected the SAP Business All-in-One solution to optimize complex supply chain processes, improve inventory control and increase order fill rates across U.S. and European operations; and H.J. Heinz added JDA's Dynamic Demand Response solution to improve visibility into its North America supply chain, enabling it to sense and respond to market demand fluctuations.

But, consumer goods companies are expressing a renewed interest in long-term planning to better consider overall supply chain costs. "We will start to see a bit of reversal of the low cost country sourcing trend to optimize total supply chain costs," says Ellis. Quality, counterfeit and recall issues are also driving this reversal.

Another trend is the movement toward tools to forecast SKUs that fall outside the high volume categories for which many tools were designed, according to Lora Cecere, research director, consumer products at AMR Research.

Reviving interest in vendor managed inventory (VMI) is also winning attention. JDA announced an end-to-end supply chain optimization solution with integrated VMI planning and execution capabilities, integrating JDA and Manugistics replenishment, planning and execution applications.

Supply chain software developers, including Oracle and SAP, continue to move to service-oriented architectures, Software as a Service and mobility to connect front office and back office applications. These firms are also increasing channel programs to penetrate small to midsize companies; JDA, for example, created an Alliance Connection program to address increased worldwide demand. Meanwhile, SAP continues to expand its vertical and geographic best practices.

Breakout Winners

Customer Experience

"Procter & Gamble (P&G) is successfully using Terra Technology's solutions in a significant portion of our business and we plan to roll out globally in the near future," says Mark Kremblewski, global business expert, demand planning,P&G. "The forecast accuracy improvement delivered by Demand Sensing enabled significant reductions in safety stock while maintaining service levels. Demand Sensing is an important part of P&G's Consumer- Driven Supply Network,helping us win at the first moment of truth."

1. Terra Technology

2. Logility

3. Oracle

Customer Experience

"Procter & Gamble (P&G) is successfully using Terra Technology's solutions in a significant portion of our business and we plan to roll out globally in the near future," says Mark Kremblewski, global business expert, demand planning,P&G. "The forecast accuracy improvement delivered by Demand Sensing enabled significant reductions in safety stock while maintaining service levels. Demand Sensing is an important part of P&G's Consumer- Driven Supply Network,helping us win at the first moment of truth."

1. Terra Technology

2. Logility

3. Oracle

SMB Market

Johnsonville Sausage LLC uses mySAP Supply Chain Management with its SAP Advanced Planning & Optimization component. "Our customers are on these programs for years. This not only provides us with a competitive advantage but also holds our feet to the fire. There's a deep trust and we are committed to sustaining the correct level of inventory at our customers' distribution centers," says Brian Harlin, master scheduler, Johnsonville Sausage LLC.

1. SAP

2. Oracle

3. i2 Technolgies

Johnsonville Sausage LLC uses mySAP Supply Chain Management with its SAP Advanced Planning & Optimization component. "Our customers are on these programs for years. This not only provides us with a competitive advantage but also holds our feet to the fire. There's a deep trust and we are committed to sustaining the correct level of inventory at our customers' distribution centers," says Brian Harlin, master scheduler, Johnsonville Sausage LLC.

1. SAP

2. Oracle

3. i2 Technolgies

Supply Chain Execution

A back-to-basics movement is spurring consumer goods manufacturers to consider investment in supply chain execution applications. Consumer goods companies will continue to spend more than others on supply chain management applications in 2008, allocating 10 percent of software budgets versus 7 percent for other industries. Overall, consumer goods companies' IT spending continues to grow with a budget increase of 9.8 percent for 2008 versus the industry average of 8 percent, according to AMR Research's "An Update on IT Spending in Consumer Products."

A back-to-basics movement is spurring consumer goods manufacturers to consider investment in supply chain execution applications. Consumer goods companies will continue to spend more than others on supply chain management applications in 2008, allocating 10 percent of software budgets versus 7 percent for other industries. Overall, consumer goods companies' IT spending continues to grow with a budget increase of 9.8 percent for 2008 versus the industry average of 8 percent, according to AMR Research's "An Update on IT Spending in Consumer Products."

It's time for a technology refresh for many warehouse management systems (WMS), and consumer goods companies are taking advantage of newer features, platforms and delivery options, including hosted WMS for small and midsize operators and enterprise branches. Consumer goods companies are also eyeing WMS to address interest in enhancing store execution, redesigning warehouse storage to enhance order fulfillment and using automated picking to decrease shipment errors, says Lora Cecere, research director, Consumer Products, AMR Research. Another boon in WMS upgrades:

Voice-directed WMS activities, an area that's "red hot now for consumer products manufacturers," says AMR Research.

Voice-directed WMS activities, an area that's "red hot now for consumer products manufacturers," says AMR Research.

Transportation management is a big focus to address five trends, says Cecere: to improve on-time deliveries to retail, to address sustainability issues by seeking cleaner transportation options, to better address direct store delivery of promotional merchandise, to gain better transportation visibility and to shift from truckload to LTL shipments where warranted to reduce inventory.

"We've forced customers to full truckload shipments, but that's too much inventory and it's buffering demand signals," explains Cecere. Simon Ellis, supply chain strategies practice director, Manufacturing Insights, an IDC company, expects increasing use of intermodal transportation by consumer goods firms.

Rising interest in transportation management systems is not lost on developers. Logility Voyager Transportation Planning and Management recently added new carrier on-boarding capabilities to enable rapid deployment and increased visibility and collaboration with carriers.

Consumer goods firms must also be increasingly concerned with sustainability, not only in product design, but in the methods and partners they choose. PepsiCo was heralded this year for its purchase of renewable energy and is evangelizing the green message to supply chain partners, scorecarding them on progress.

After a few years of lukewarm interest, consumer goods companies are starting to invest in warehouse labor management to ensure the right number of workers with the right skills are deployed exactly when needed to meet business objectives and customer demand. Companies are also exploring the emerging category of inventory optimization to strike the same right time/place/quantity formula.

In the wake of recalls, tainted product scandals and counterfeiting, a rising call for product traceability has vendors such as RedPrairie and HighJump unveiling traceability tools, says Cecere. "The big guys are building it into their platforms," says Ellis.

Breakout Winners

Customer Experience

"Manhattan Associates' solutions have been an integral part of increasing our distribution productivity and improving quality service to booksellers," according to Drew Bordas, director,Warehouse Management Systems for the Ingram Book Group."The time Manhattan Associates invested and its ability to execute the technology allowed us to implement the solutions without interrupting service to our customers."

1. Manhattan Associates

2. Logility

3. Jesta I.S.

Customer Experience

"Manhattan Associates' solutions have been an integral part of increasing our distribution productivity and improving quality service to booksellers," according to Drew Bordas, director,Warehouse Management Systems for the Ingram Book Group."The time Manhattan Associates invested and its ability to execute the technology allowed us to implement the solutions without interrupting service to our customers."

1. Manhattan Associates

2. Logility

3. Jesta I.S.

SMB Market

"For Wilton the benefits from Oracle Demantra were a 20 percent decrease in inventory. That also allowed me to increase annual turns by half a turn, which is a big deal. My fill rate is 97 percent to 98 percent consistent every single month against a goal of 95 percent. Sales now believes that I'm going to deliver.There's a lot more increased communication between sales and SCM, and we think that was the key," says Wendy Malloy, director of Forecast and Inventory Planning,Wilton Enterprises.

1. Oracle

2. 3M/HighJump

3. SAP

"For Wilton the benefits from Oracle Demantra were a 20 percent decrease in inventory. That also allowed me to increase annual turns by half a turn, which is a big deal. My fill rate is 97 percent to 98 percent consistent every single month against a goal of 95 percent. Sales now believes that I'm going to deliver.There's a lot more increased communication between sales and SCM, and we think that was the key," says Wendy Malloy, director of Forecast and Inventory Planning,Wilton Enterprises.

1. Oracle

2. 3M/HighJump

3. SAP

RFID Hardware

The top three winners for RFID hardware in our annual Readers' Choice Survey are also the most innovative when it comes to driving the technology forward. Hewlett-Packard (HP) is currently enabling complete RFID, research and development, and innovation within its enterprise. Intermec has completely refreshed its product lines in 2007 according to end user and customer requirements, including form factors, batteries and applications. Intermec's line of RFID hardware devices is also now supported by Microsoft Corp.'s BizTalk Server 2006 R2, which gives customers a uniform way to communicate with and manage RFID devices on the Microsoft Windows platform. Zebra Technologies diversified its offerings by acquiring WhereNet and Navis in the RFID market and realtime solutions space. The company is enhancing its wireless capabilities and offers real-time location services, like asset tracking for inventory control according to product value as an alternative to cheaper passive solutions. Other applications include security access control and supply chain management through RFID.

The top three winners for RFID hardware in our annual Readers' Choice Survey are also the most innovative when it comes to driving the technology forward. Hewlett-Packard (HP) is currently enabling complete RFID, research and development, and innovation within its enterprise. Intermec has completely refreshed its product lines in 2007 according to end user and customer requirements, including form factors, batteries and applications. Intermec's line of RFID hardware devices is also now supported by Microsoft Corp.'s BizTalk Server 2006 R2, which gives customers a uniform way to communicate with and manage RFID devices on the Microsoft Windows platform. Zebra Technologies diversified its offerings by acquiring WhereNet and Navis in the RFID market and realtime solutions space. The company is enhancing its wireless capabilities and offers real-time location services, like asset tracking for inventory control according to product value as an alternative to cheaper passive solutions. Other applications include security access control and supply chain management through RFID.

"The current trends in RFID hardware are about price, performance, features and functionality, reliability, form factor, mobility and the intelligence of the reader for specific applications," explains Michael Liard, research director, RFID and contactless for ABI Research. Form factor considerations include durability, battery life, weight, size, ruggedness, portable printing and mobility. Tag innovations continue to develop, from different types and sizes to the encasing of tags, and frequency selection is increasing alongside form factor selection in the marketplace.

"RFID is about business process change. Look at your business problems and identify your pain points. How can RFID fix these? If you're thinking about RFID technology, make sure you have an appropriate internal IT champion and a business process person, plus a marketing person, on your team to leverage the RFID data to increase your ROI," advises Liard. For Trade Promotion Management, RFID can track when products hit the sales floor, whether or not they reached there on time, and the point-of-sale sales uplift according to that timing.

"Only 50 percent of products make it on time for promotions to sell on the shelves," he explains. "RFID can save on labor costs for checking on 'problem children' stores in this regard. Procter & Gamble is doing this with the pharmacies and with Wal-Mart. They put a reader at the back door and at the entrance to the sales floor. Then they put one in the box crusher to ensure the product doesn't end up there. There's definitely ROI to be had there."

To ensure ROI on your RFID investment, you need to be very application and user specific in your procurement. The total cost of ownership needs to include the pilot price with the long-term costs -- which might prove to be the best source of ROI in the long term. For high-value, high-risk items, like consumer electronics, fashion apparel and footwear, RFID is ideal for asset and supply chain management, as well as for anti-counterfeiting measures. The tag cost needs to be justified by the price points, at least until RFID hardware costs come down for consumer goods applications.

Breakout Winners

Customer Experience

In December 2007, Motorola formed a strategic relationship with Intelleflex to deliver Extended Capability RFID solutions."The combination of Motorola's RFID leadership and Intelleflex' breakthrough extended capability RFID technology is compelling. It will allow us to deliver powerful new solutions to our current and future customers in automotive,food and drug,electronics, government, healthcare and other industry sectors," says Mike Lowry, president, Lowry Computer Products.

Customer Experience

In December 2007, Motorola formed a strategic relationship with Intelleflex to deliver Extended Capability RFID solutions."The combination of Motorola's RFID leadership and Intelleflex' breakthrough extended capability RFID technology is compelling. It will allow us to deliver powerful new solutions to our current and future customers in automotive,food and drug,electronics, government, healthcare and other industry sectors," says Mike Lowry, president, Lowry Computer Products.

1. Motorola

2. Hewlett-Packard

3. Avery Dennison

2. Hewlett-Packard

3. Avery Dennison

SMB Market

Hewlett-Packard's (HP) RFID solutions and services are based on unique industry and business needs to help organizations increase manufacturing efficiencies and enable the next-generation supply chain.HP RFID can enable companies to meet customer and compliance mandates; improve ability to accurately determine inventory at various stages of production; reduce cycle times through automation; lower operational risks; improve return on investment; enhance customer satisfaction and loyalty.

Hewlett-Packard's (HP) RFID solutions and services are based on unique industry and business needs to help organizations increase manufacturing efficiencies and enable the next-generation supply chain.HP RFID can enable companies to meet customer and compliance mandates; improve ability to accurately determine inventory at various stages of production; reduce cycle times through automation; lower operational risks; improve return on investment; enhance customer satisfaction and loyalty.

1. Hewlett-Packard

2. Motorola

3. Intermec

2. Motorola

3. Intermec

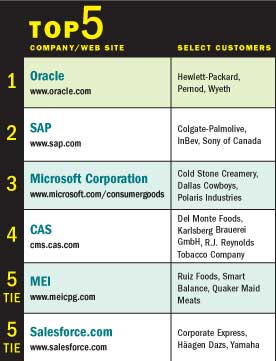

ERP

The pressure of globalization requires consumer goods firms to obtain a unified view of their business to ensure profitability. So, it comes as no surprise that ERP budgets are growing. According to AMR Research, 47 percent of large enterprises will increase ERP budgets in 2008 and their ERP budgets will grow 5.4 percent on average in 2008. Similarly, 48 percent of midsize enterprises will increase their ERP budgets, with an expected average increase of 5.1 percent in 2008. Our Top 5 ERP companies are sure to be recipients of those swelling investments.

Breakout Winners

Customer Experience

"The insight into our activities has increased 1000 percent, so to speak, now that QAD is our central information backbone. All employees have access to the same information, which makes us much more efficient. As QAD is tailored to specific issues in our industry, including rules and regulation, we are able to operate more flexibly. Everything is stored in a uniform way and that's an ideal situation," says Ton Mens, controller, Agio Cigars.

Customer Experience

"The insight into our activities has increased 1000 percent, so to speak, now that QAD is our central information backbone. All employees have access to the same information, which makes us much more efficient. As QAD is tailored to specific issues in our industry, including rules and regulation, we are able to operate more flexibly. Everything is stored in a uniform way and that's an ideal situation," says Ton Mens, controller, Agio Cigars.

1. QAD

2. Microsoft Corporation

2. Microsoft Corporation

SMB Market

Butterball LLC formed in 2006 when Carolina Turkeys acquired the Butterball brand from ConAgra Foods. Carolina Turkeys deployed an SAP ERP application in less than seven months, then scaled the initial deployment to integrate the Butterball assets -- growing from $500 million to $1.5 billion in revenue within five months. "When we learned there was a preconfigured solution designed for our industry, we immediately began investigating the SAP software and realized it fit our needs perfectly," says Ron Wells, CIO, Butterball LLC.

Butterball LLC formed in 2006 when Carolina Turkeys acquired the Butterball brand from ConAgra Foods. Carolina Turkeys deployed an SAP ERP application in less than seven months, then scaled the initial deployment to integrate the Butterball assets -- growing from $500 million to $1.5 billion in revenue within five months. "When we learned there was a preconfigured solution designed for our industry, we immediately began investigating the SAP software and realized it fit our needs perfectly," says Ron Wells, CIO, Butterball LLC.

1. SAP

2. Oracle

2. Oracle

CRM

CRM encompasses sales, marketing and customer service, a definition that leads to a lot of variety in the marketplace. Research in CGT and AMR Research's 2007 Tech Trends Study showed that many organizations turned away from traditional CRM investments for a short time, as ambiguity led to application overspending and under-utilization. But consumer goods firms are ready to re-invest in managing the customer experience as enhanced user interfaces and ondemand options come to market from the CRM leaders listed here.

Breakout Winners

Customer Experience

"We are extremely happy with the implementation.CPWerx satisfies all our expectations with regard to technology, scope of functionality, process efficiency and flexibility -- even after an implementation period of just four months for the first phase," explains Stefan Matheis,CRM project manager,Karlsberg Brauerei GmbH."User acceptance has been overwhelming and extraordinary for a software project of this magnitude. Our field sales staff is really enthusiastic."

Customer Experience

"We are extremely happy with the implementation.CPWerx satisfies all our expectations with regard to technology, scope of functionality, process efficiency and flexibility -- even after an implementation period of just four months for the first phase," explains Stefan Matheis,CRM project manager,Karlsberg Brauerei GmbH."User acceptance has been overwhelming and extraordinary for a software project of this magnitude. Our field sales staff is really enthusiastic."

1. CAS

2. MEI

2. MEI

SMB Market

Polaris Industries is one of the largest manufacturers of all-terrain vehicles and a recognized leader in the snowmobile industry.According to Bede Braegelmann, project manager for Sales,Service & Marketing for Polaris Industries. "One hour after implementing Microsoft CRM, a dealer called to discuss an open case.With one click, the support representative accessed the records needed to successfully handle the call."

Polaris Industries is one of the largest manufacturers of all-terrain vehicles and a recognized leader in the snowmobile industry.According to Bede Braegelmann, project manager for Sales,Service & Marketing for Polaris Industries. "One hour after implementing Microsoft CRM, a dealer called to discuss an open case.With one click, the support representative accessed the records needed to successfully handle the call."

1. Microsoft Corporation

2. SAP

2. SAP

Trade Promotion Management

In 2007, the trade promotion management (TPM) space continued to mature, according to Gartner's Dale Hagemeyer, research vice president, Manufacturing - Life Sciences and Consumer Goods. He comments that this is evident in the fact that the Top 10 ratings are a mix of suite vendors, point solution vendors and those dedicated to optimization of TPM.

In 2007, the trade promotion management (TPM) space continued to mature, according to Gartner's Dale Hagemeyer, research vice president, Manufacturing - Life Sciences and Consumer Goods. He comments that this is evident in the fact that the Top 10 ratings are a mix of suite vendors, point solution vendors and those dedicated to optimization of TPM.

"What I see is that smaller consumer goods companies usually go with the hosted solutions, while the larger companies stay with the suites that allow for customization and cover more key selling processes. This makes sense because the smaller consumer goods companies often see TPM as an urgent need, but not in the context of a more complete solution including category management, retail execution and monitoring, and volume planning," says Hagemeyer.

We asked Hagemeyer to further comment on the evolution of the TPM market. Here's what he had to say: "Optimization beyond transactional is critical; the cycle of 'plan-execute-pay' was grossly in need of automation. But now, with optimization and predictive modeling added to TPM, it promises to open up a new horizon of spending more time looking out the windshield at the future instead of in the rear view mirror at the past.

"There are companies doing innovative things to move TPM forward. Some of this may be directly related to TPM such as predictive modeling and some of it may be as an enabler to TPM such as point-of-sale data analytics, marketing mix modeling and shelf management.

"Durable and semi-durable consumer goods companies are still not as well represented in TPM as they should be. Earlier in the decade, I attributed this to the down economy. But the trend has persisted. The consumables companies continue to outpace the other categories.

"Watch for more consolidation among the hosted TPM vendors; watch for continued polarization as the multi-billion dollar consumer goods companies stay with the suite solutions that allow for customization and a broader footprint of salesrelated activities; and watch for optimization and predictive modeling to play a greater role in how consumer goods companies go to market."

Regarding our top three TPM vendors: Oracle's Application Integration Architecture was announced in April 2007. The company also indicated that the release of the Siebel CRM Trade Promotions and Deductions Integration Pack for Oracle E-Business Suite is expected to provide a closed-loop trade promotional process for consumer goods companies, encompassing trade promotion creation and settlement flows.

SAP introduced the "next evolution" of SAP Customer Relationship Management in December 2007. New capabilities include enhanced TPM and Market Development Funds applications to help customers "extract more out of their promotional spend, while securing greater visibility, control and traceability of end-to-end funds and claims processes."

MEI announced it signed four additional client partners during November: Alacer Corporation, Kettle Foods, Quaker Maid Meats and Smart Balance. These companies will leverage the hosted Troubadour solution.

Breakout Winners

Customer Experience

"Adesso Solutions has given us the ability to take a strangle hold on our receivables," says Bill Chappell, trade marketing manager, Redox Brands."Promotional funding is accrued as an "on going" process, and the dreaded surprise deduction has all but been eliminated."

Customer Experience

"Adesso Solutions has given us the ability to take a strangle hold on our receivables," says Bill Chappell, trade marketing manager, Redox Brands."Promotional funding is accrued as an "on going" process, and the dreaded surprise deduction has all but been eliminated."

"Not only is MEI easy to use and easy to achieve results, they treat their clients like Pinnacle Foods treats and respects our clients and consumers. This relationship is what makes MEI so successful," says Santa Pandolfo, director of Sales Operations and Customer Specific Marketing, Pinnacle Foods.

1. (tie) Adesso Solutions

1. (tie) MEI

2. SAP

1. (tie) MEI

2. SAP

SMB Market

"With trade dollar spending consuming a greater and increasing portion of our promotional budget we had a need to ensure that we are getting the best value for each dollar spent," says Merl McGriff, senior manager of Sales Administration & Logistics, Red Gold Inc."With the Demantra Trade Fund Management Software we can now quickly and efficiently track and evaluate all of our trade spending programs and make them much more effective."

"With trade dollar spending consuming a greater and increasing portion of our promotional budget we had a need to ensure that we are getting the best value for each dollar spent," says Merl McGriff, senior manager of Sales Administration & Logistics, Red Gold Inc."With the Demantra Trade Fund Management Software we can now quickly and efficiently track and evaluate all of our trade spending programs and make them much more effective."

1. Oracle

2. Adesso Solutions

3. MEI

2. Adesso Solutions

3. MEI

New Product Development & Introduction

"The increased demand for innovation from consumers and retailers -- and the high failure rates of successful introductions -- means that there is a growing need to develop more new products every year. As a result, consumer goods companies are increasingly adopting new product development solutions to manage the costs of product development and focus attention on the most likely winners," says Peter Bambridge, research director, Manufacturing IAS, Gartner Industry Advisory Services.

"The increased demand for innovation from consumers and retailers -- and the high failure rates of successful introductions -- means that there is a growing need to develop more new products every year. As a result, consumer goods companies are increasingly adopting new product development solutions to manage the costs of product development and focus attention on the most likely winners," says Peter Bambridge, research director, Manufacturing IAS, Gartner Industry Advisory Services.

But what makes something innovative? Cheryl Perkins, president of Innovation Edge, says, "Here is the simplest definition: Innovation is any product or service that delivers desirable experiences for your consumers and sustainable growth for your company. In other words, innovation delivers economic value." She says to create and deliver outstanding customer experiences, leaders are discovering that there are multiple combinations of processes, technology and interaction "must-haves" to bring a new offering to market.

Of course those process leaders and technology providers that support innovation appear in our Top 10 list. Microsoft is emphasizing innovation as a process, using partners -- many of which are on the Top 10 list -- for formal PLM applications. In addition, it is helping clients to leverage standard MS tools and applications such as SharePoint and Office to automate and improve new product development and innovation through collaboration.

No. 2 Oracle acquired Agile mid-year 2007. Oracle President Charles Phillips says in a press release, "Profitable product innovation is critical to product-based industries, making PLM one of the fastest growing application segments. The addition of Agile, which will serve as the foundation of our PLM offering, will further Oracle's strategy of delivering industry-specific enterprise applications."

In August 2007, SAP unveiled its road map for the SAP PLM application, which, according to SAP, will help companies successfully address the accelerated speed of change and the need to differentiate through innovation within their business network. Over the next three years, the extended application will build on existing SAP PLM capabilities to provide an end-to-end solution.

In 2008, Perkins says the biggest trend around innovation will be "the continued gravitation toward using more structured tools and methods for discovering and understanding the needs of customers, analyzing the insights gained from customer and market research, and synthesizing these emergent patterns into desirable customer experiences." Partnership strategies will change as "truly innovative" companies engage multiple partners to build a strong competitive advantage. "As open innovation practices become more prevalent, managing and integrating between partners becomes a much higher management imperative," concludes Perkins.

Bambridge adds, "We see the market continuing to consolidate as vendors fight to grow market share and extend their solution footprints...We see increased interest in 'green' and ethical issues." He also sees new product development moving from a "product specific focus to one that is more product portfolio focused."

Breakout Winners

Customer Experience

"Tyson Foods has an excellent strategic supply partner program.With Prodika [now Oracle Agile PLM for Process], we will drive for even more effective supplier relationships and rationalization of ingredients, leading to improved optimization of new and existing products," Hal Carper, senior vice president,research and development, Tyson Foods, told CGT in September 2007. The company was early in its implementation, but Carper said benefits had already been realized.

Customer Experience

"Tyson Foods has an excellent strategic supply partner program.With Prodika [now Oracle Agile PLM for Process], we will drive for even more effective supplier relationships and rationalization of ingredients, leading to improved optimization of new and existing products," Hal Carper, senior vice president,research and development, Tyson Foods, told CGT in September 2007. The company was early in its implementation, but Carper said benefits had already been realized.

1. Oracle

2. Paxonix

3. IBM

2. Paxonix

3. IBM

SMB Market

"The spark behind our innovation comes from engineers and conceptual designers working together with customers as well as other employees," says John Loo, senior manager of Design Systems at Callaway Golf, a Microsoft Corporation client."With the collaborative functions available in our SharePoint-based portal, team m

"The spark behind our innovation comes from engineers and conceptual designers working together with customers as well as other employees," says John Loo, senior manager of Design Systems at Callaway Golf, a Microsoft Corporation client."With the collaborative functions available in our SharePoint-based portal, team m